RevolutionParts has partnered with Avalara to provide Parts Departments with a simple solution that ensures they remain tax compliant on every eCommerce parts transaction, in and out of state. Enjoy this guest post from Avalara:

States are expanding their sales tax collection requirements during this explosive eCommerce growth, which can complicate sales tax compliance for online retailers selling OEM automotive parts into multiple states.

In 2018, eCommerce represented 14.3% of the total retail trade. By comparison, in 2020, it jumped to 21.3%. With the online share of total retail sales rising quickly, it is beneficial to consider how online sales affect sales tax nexus.

Nexus Creates a Sales Tax Collection Obligation

Nexus connects business and a state that requires the business to register and then collect and remit sales tax. A physical location, such as a store or a warehouse, will create nexus. However, there is also something called “economic nexus,” which depends solely on the economic activity of a business in a state (for example, $100,000 in annual sales). All states have adopted economic nexus with a sales tax, with the exception of Missouri and Florida.

As sales continue to increase for digital retailers, the likelihood of establishing economic nexus in one or more states also grows. Once that obligation to collect sales tax is triggered, retailers need to ensure collection at the right rate in every sales tax jurisdiction.

The United States Contains More Than 13,000 Tax Jurisdictions

Forty-five states and the territory of Washington, D.C., currently maintain a statewide sales tax, and 38 states maintain local sales taxes. There is no general sales tax in Alaska, Delaware, Montana, New Hampshire, and Oregon, although Alaska does allow local sales taxes.

Altogether, there are more than 13,000 different sales and use tax jurisdictions in the United States. A couple of interesting examples are Oklahoma, with 580 sales tax jurisdictions, and Texas, with roughly 1,500. On top of the state, county, and municipal jurisdictions, there are numerous special districts. This includes, but is not limited to, school districts, economic districts, ambulance districts, and transportation districts. Sometimes local and special districts overlap.

At least one sales and use tax rate is associated with each jurisdiction. Some jurisdictions — like several in Missouri — allow different rates for use tax, food, utilities, and more. For each transaction, online retailers must collect the total combined rate in effect in the location the sales originate: the state rate (except in Alaska) and any applicable local and special district rates.

Selling online into multiple jurisdictions can easily become overwhelming because of the enormous task of assigning the correct rate to every transaction. Anyone using ZIP codes to determine sales tax rates quickly learns that ZIP codes do not perfectly align with sales tax jurisdictions. As an example, in the city of Boulder, Colorado, jurisdiction code 07-0003 includes ZIP codes 80304 and 80301.

Also, take note that tax rate tables can quickly become outdated. For example, in 2019, more than 34,000 sales and use tax rate and taxability changes occurred in the U.S. and Canada. When a change occurs in a jurisdiction, the tax rate table for that jurisdiction becomes outdated and will need to be updated.

Geolocation: The Right Tool for the Job

Instead of relying primarily on static tax and ZIP code tables, use geolocation technology to ensure and apply the most up-to-date rates and rules to each online transaction. Geolocation generates rates with rooftop-level precision — and this is essential for compliance.

Different Sides of a Street Can Have Varying Sales Tax Rates

It is not uncommon for a different sales tax rate to be on either side of the same street. For example, in Colorado Springs, the sales tax rate on the west side of E. Las Vegas Street is 5.13%. However, the sales tax rate on the east side of E. Las Vegas Street is 8.2%. Who would know this?

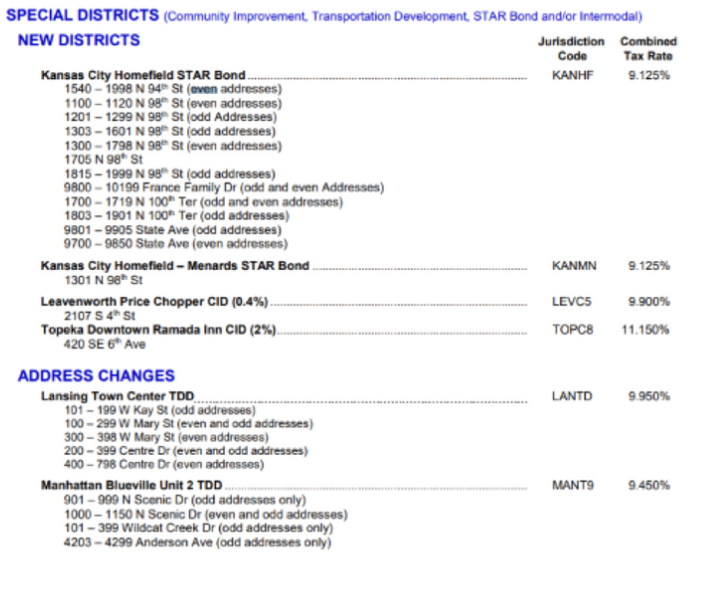

Kansas is a genuine poster child for complicated sales tax calculations. Often, special districts can have even-numbered addresses on some streets and odd-numbered addresses on others. Special districts come and go and are subject to change, as this rate change notice for April 2021 shows. Take a look at this mind-boggling snapshot:

In most cases, product taxability rules on either side of a street will be the same even if the rates are different. However, this isn’t always the case!

For example, in the twin towns of Bristol, the south side of W. State Street is in Tennessee, while the north side of W. State Street is in Virginia. Thus, Tennessee law dictates the taxability rules on the south side of W. State Street, while the taxability rules on the north side of the street are dictated by Virginia law. This could amount to some seriously tedious research on the part of an online retailer that wants to remain sales tax compliant.

During Tennessee’s annual sales tax holiday, typically occurring the last weekend in July, qualifying clothing, school supplies, and computers are exempt from Tennessee sales tax on the Tennessee side but subject to Virginia sales tax on the Virginia side. During the following weekend, the Virginia sales tax holiday, qualifying products are exempt from sales tax on the Virginia side and taxable on the Tennessee side. Sounds complicated, doesn’t it?

Sales Tax Rates and Reporting Requirements Do Change

Counties and municipalities in Alabama are required to notify the Alabama Department of Revenue in writing at least 60 days prior to the effective date of a new tax or an amendment. However, the department may not receive or post rate change notices until a few days before a change takes place — or even weeks or months after a change took is in effect.

While notices often pertain to new tax levies or changing rates, they sometimes announce a reporting code change or an administrative change. Alabama, like Colorado, Louisiana, and several other states, is a home rule state. This means local governments have the authority to administer and collect local sales taxes. While some local governments do this, others have the Alabama Department of Revenue administer and collect local taxes on their behalf.

Occasionally, a local tax authority may discontinue services from the Alabama Department of Revenue, opting to administer local sales tax itself. The inverse can be true other times, and a local government can ask the state tax authority to administer and collect sales tax.

Updates to point-of-sale systems must be made to reflect all rate changes, and the reporting and remittance of some local sales taxes will be with local tax authorities while others will be filed with the Alabama Department of Revenue.

For online retailers with an obligation to collect and remit sales tax in Alabama, it’s a lot to keep track of.

Sales Tax Holidays and Product Taxability Changes

Rates for specific products may also be subject to change in every state. For instance, several states imposed new taxes on soda and other sweetened beverages; others carved out new exemptions for diapers.

Thousands of products that are typically taxable are temporarily exempt during state sales tax holidays. For instance, Alabama’s sales tax holiday for severe weather preparedness and Maryland’s energy-efficient appliances sales tax holiday affected almost 7,000 different products this last February. Approximately 17 states have one or more sales tax holidays each year. In 2019, there were more than 115,000 sales tax holiday rule updates in the U.S.

Because of sales tax holidays, rate and product taxability changes, boundary changes, and other factors, online retailers should not simply set sales tax rates in their POS systems and forget about them. Sales tax changes that will affect compliance must be addressed promptly. After all, applying an incorrect rate or code to a transaction can lead to shopping cart errors and system errors, something no online retailer wants their customer to experience.

A better way to stay sales-tax compliant is to automate. Avalara AvaTax is a cloud-based sales and use tax calculation solution that relies on geolocation technology to pinpoint exact locations, rules, and rates. This solution takes special rates and circumstances into account, such as product-specific rates and sales tax holidays. It also monitors business activities and sends alerts when a nexus obligation is met in a new jurisdiction.

Avalara partners with RevolutionParts to eliminate the need for online retailers to handle the compliance associated with selling OEM automotive parts out of state. If you want to provide customers with an impressive and simple shopping experience that also automates sales-tax compliance, visit www.revolutionparts.com today to learn more, or schedule a personalized demo today!